Cloud Based Accounting Software

Cloud Based Accounting Software

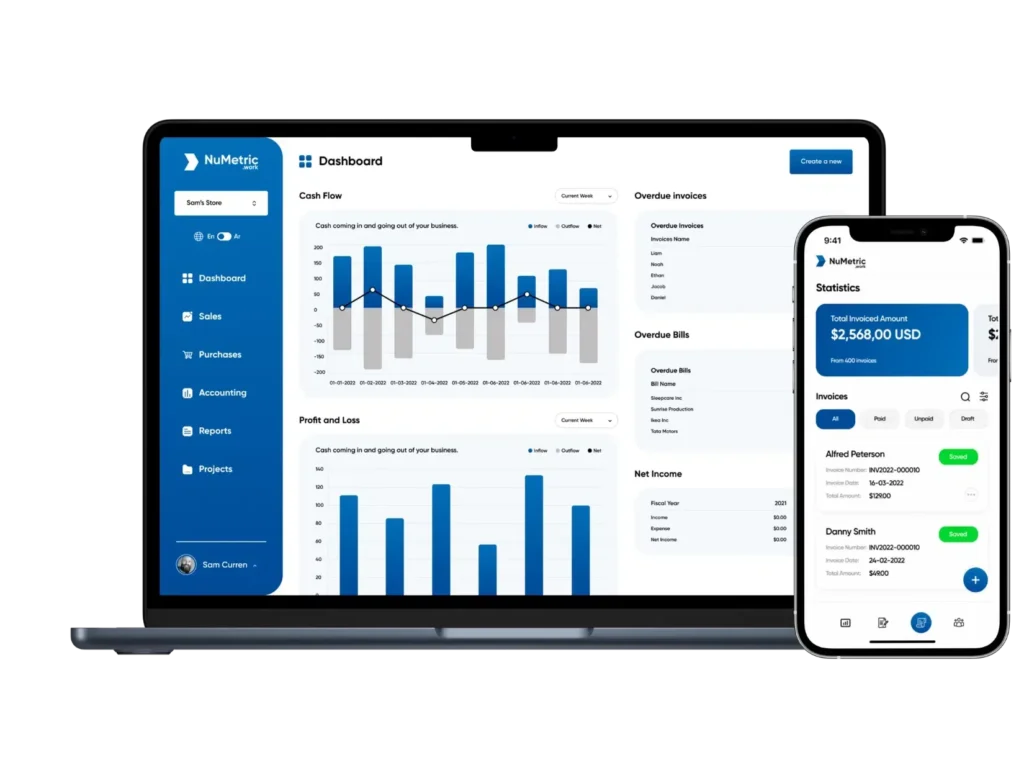

Where Strength Meets Design

NuMetric.work is an online accounting tool tailored for self-employed individuals and small businesses, designed to simplify financial management. It offers a range of features such as invoice creation, expense tracking, and handling various accounting tasks, making it easy for users to stay on top of their bookkeeping.

Built with entrepreneurs and small business owners in mind, the platform empowers users to independently manage their complete financial records. For those who need professional assistance, NuMetric.work allows advisors easy access to monitor and review financial activities.

The platform supports the creation of professional, visually appealing estimates and invoices in both Arabic and English, with the flexibility to use any currency. Additionally, users can generate powerful, intuitive financial reports to track business transactions and performance, helping them make informed decisions.

NuMetric.work goes beyond basic accounting by offering additional features such as budgeting tools, inventory item tracking, employee payroll generation, and a learning platform that teaches users how to navigate the software. These enhancements provide a comprehensive solution, enabling seamless management of financial processes and addressing a wide range of business needs.

Challenges:

Working on NuMetric presented several challenges, particularly in the realm of accounting software. Developers needed a strong understanding of accounting principles and had to implement a well-structured schema to ensure data storage adhered to these standards. As we defined the project scope, additional requirements emerged, such as the ability to customize invoices, support multiple email logins for a single account, and enable the platform to send private transactional emails.

For subscription management, we integrated PayPal as our payment aggregator. However, we encountered several limitations, especially when it came to managing subscription upgrades and downgrades. Incorporating third-party services also proved challenging, as we had to adjust our application logic to accommodate their specific principles and requirements.

Solution

At the start of the project, we recognized the need for the team to gain a clearer understanding of accounting principles. To achieve this, we consulted with several financial experts, which allowed us to quickly build a solid foundation in key accounting rules. One of the more complex challenges was creating customizable PDF invoices. To address this, we developed application logic that supported customization and integrated a PDF generation library in Node.js, providing a flexible solution for future modifications.

To ensure user data privacy when sending transactional emails, we implemented a feature that allowed users to configure their own email settings through Amazon SES, rather than relying on a standard platform mail service. For subscription management, we chose PayPal as the payment aggregator, as it met region-specific requirements. Given the presence of multiple subscription tiers and the option for users to upgrade or downgrade between them, we built application logic that handled these transitions, along with any additional charges outlined in the project scope.

When integrating Zapier as a third-party service, we initially faced the challenge of rewriting backend APIs to enable communication with their services. Instead of doing this, we developed middleware mapper functions, which expedited the process and resulted in faster, cleaner code while maintaining efficiency in communication with external services.